In times of uncertainty, it pays to be sure

Bitcoin has outperformed every other asset over the last 14 years. It's time to make it a part of your portfolio.

Core Bitcoin Holding

De-Risking Mechanism

Reinvestment and Opportunistic Buying

Long-Term Perspective

Big Island Capital Management

What we do

Founded in 2023, we are dedicated to delivering bitcoin exposure to high net worth individuals, and companies looking to benefit from the best performing asset of the last decade. We do the hard work on our end to preserve your wealth, so you can stay focused on your day to day.

Occams Razor

Often in life, the simplest answer is the correct one. That rings true with Bitcoin as well.

Traditional asset managers fumble around with 60/40 portfolios, and love diversification. Until bitcoin this was the easy way to mitigate risk, and maximize risk adjusted returns; and most professionals still think this way.

Lucky for you, we adapted and actually learned how bitcoin works and why if fits perfectly into the world we see ourselves heading into all over the globe.

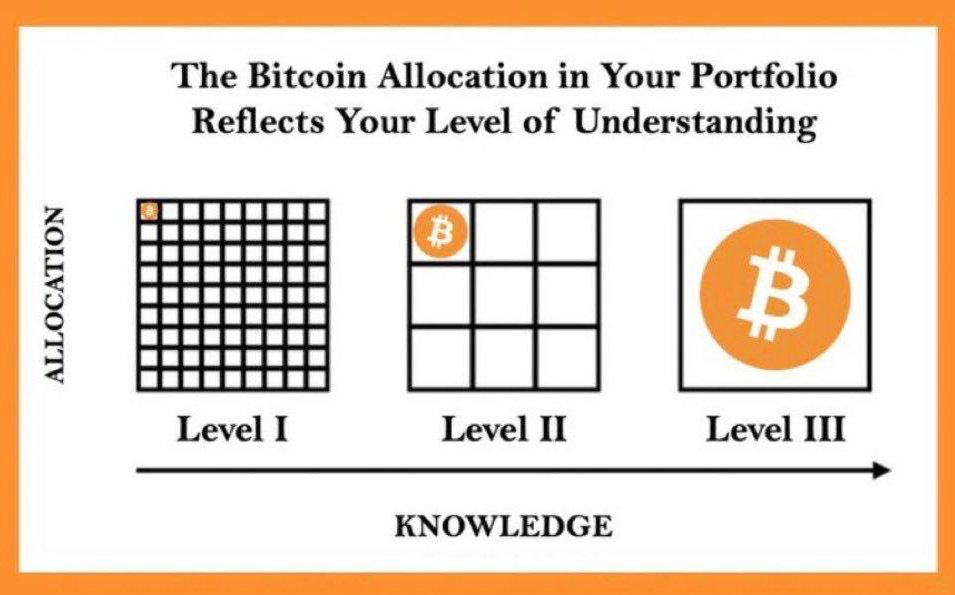

It's our understanding of bitcoin that turn it from risky, to the least risky asset across time. From too volatile, to understanding why its volatile; that a simple rebalancing strategy through these cycles helps accumulate bitcoin held by the fund, turning that volatility from a liability to an asset.

Bitcoin too risky? What is risk?

Everything goes to $0 against bitcoin over time

We take a long term view of risk, and the data shows its risky to be in anything BUT bitcoin over med-long term timeframe

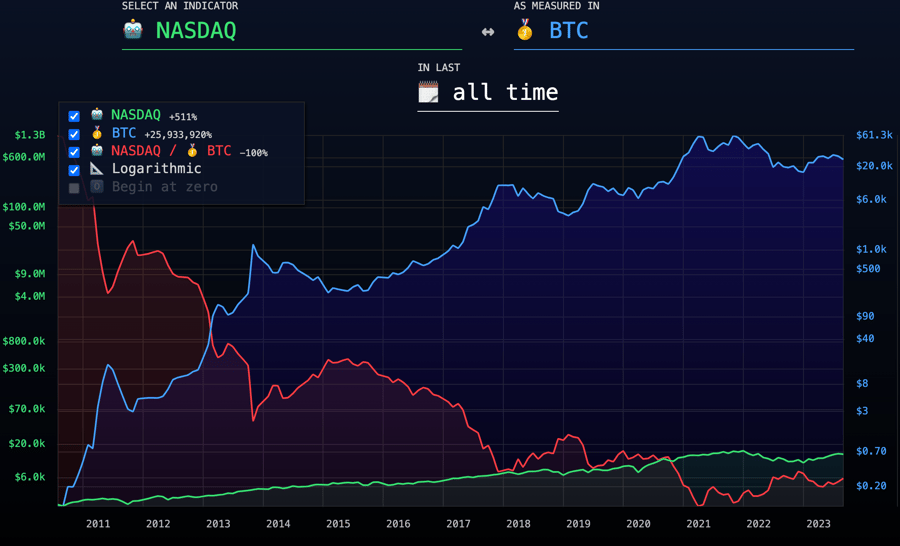

NASDAQ

NASDAQ: down 99%+ since 2010

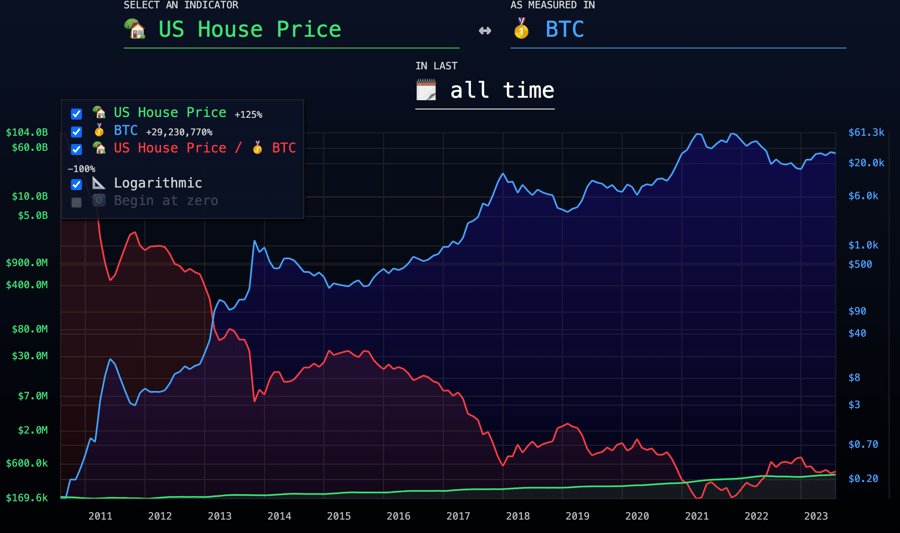

Housing

Housing: down 99%+ since 2010

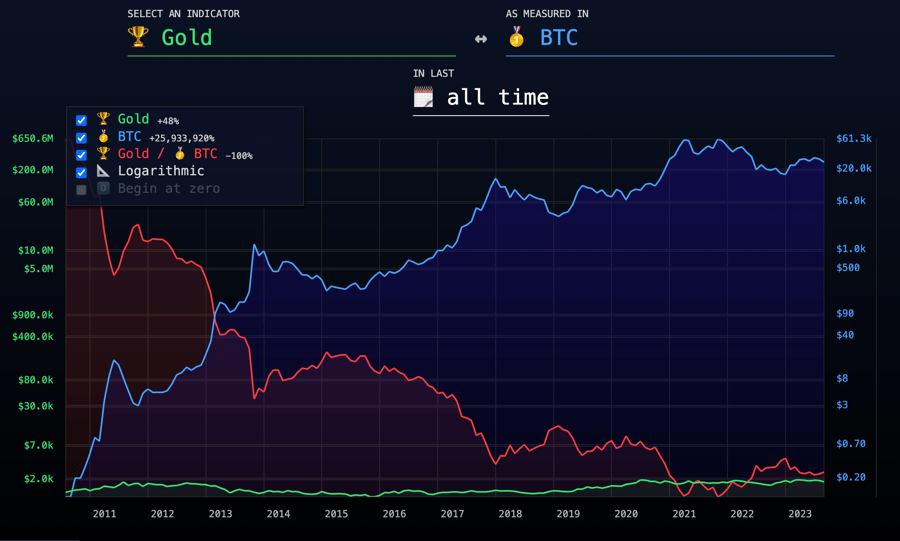

Gold

Gold: down 99%+ since 2010

Bitcoin at Level 3

The time was yesterday to put your money in the hardest asset in the world

Find Full Portfolio Diversity

Grow your business with confidence; we grow your wealth with the same.

By focusing on what you're good at, you can continue to work the margins, staying in the moment and in tune with the day to day.

At Big Island Capital Management, we will stay engrossed in keeping up to date with the world of finance, macroeconomics, monetary policy, geopolitics, regulation, and all the other factors that play greatly into the positive growth of this fund over time.

“Our thesis is that bitcoin is digital property without the risks and liabilities of commercial real estate. It's a digital commodity without the risks and liabilities of gold. It's a digital tech investment without the risks and liabilities of tech companies”

Michael SaylorExecutive Director - Microstrategy

'We found that the most efficient increase in risk-adjusted returns, measured using the Sharpe ratio, came from the first 50-100 basis points of bitcoin allocation from an otherwise traditional portfolio. "Getting off zero", in reference to a portfolio with a zero percentage bitcoin allocation, is arguably one of the most important modern-day investment decisions for those who have not considered it yet.'

Fidelity$4.5 Trillion in Assets Under Management

Have a question?

Get in touch

Simply fill out the form below and our team will be in touch.